In The RISK Rituals, we seek to understand and leverage risk so that we can consistently take smart risks and, most importantly, convert those risks into reward. It’s critical to our success that we learn to avoid being suckered into taking stupid risks – a risk that likely will be someone else’s reward.

With more and more of our lives spent online, there is a big risk that we really need to better understand. It’s the risk of the internet itself. It’s the risk that information being presented to us as objective and impartial isn’t what it seems.

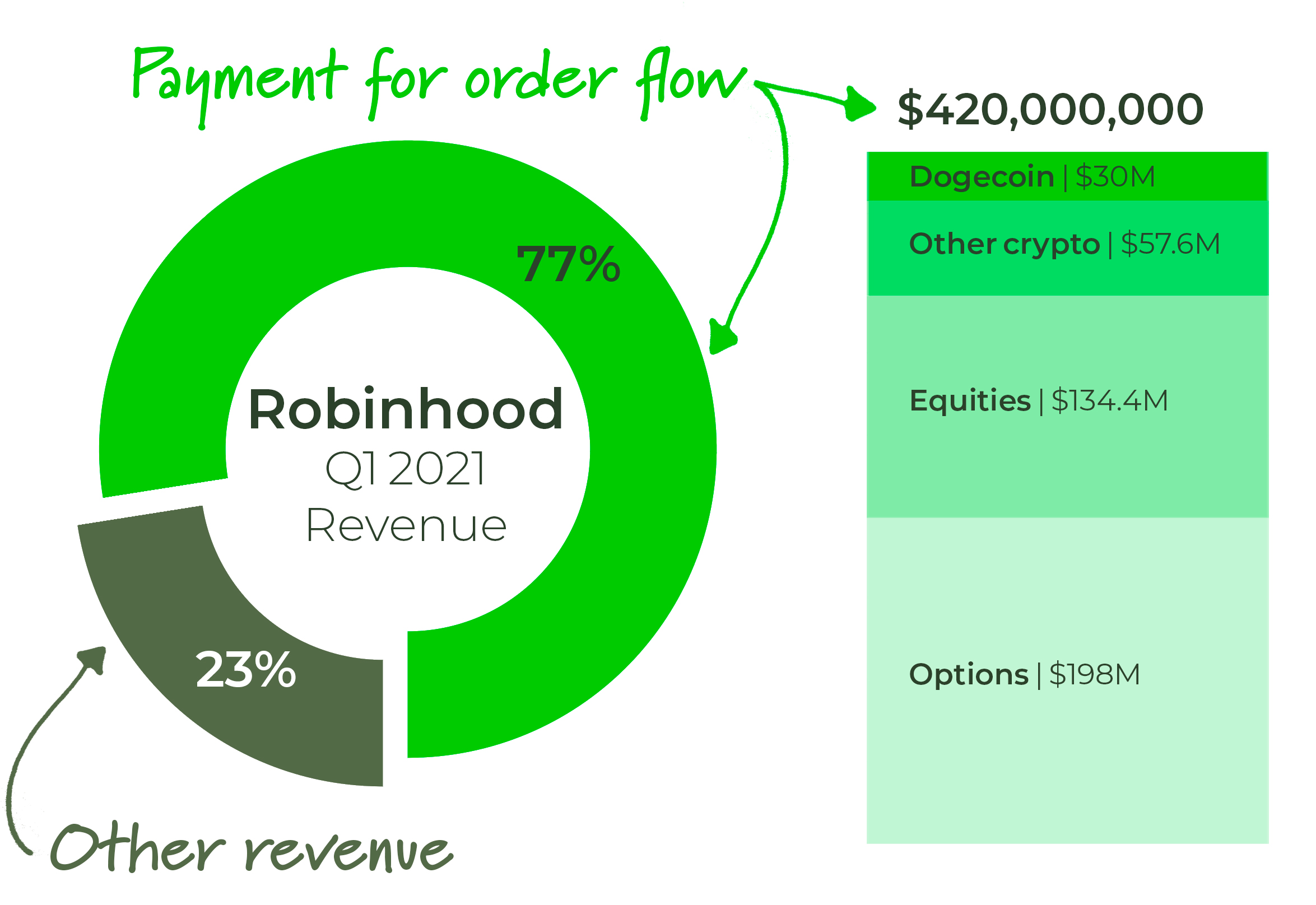

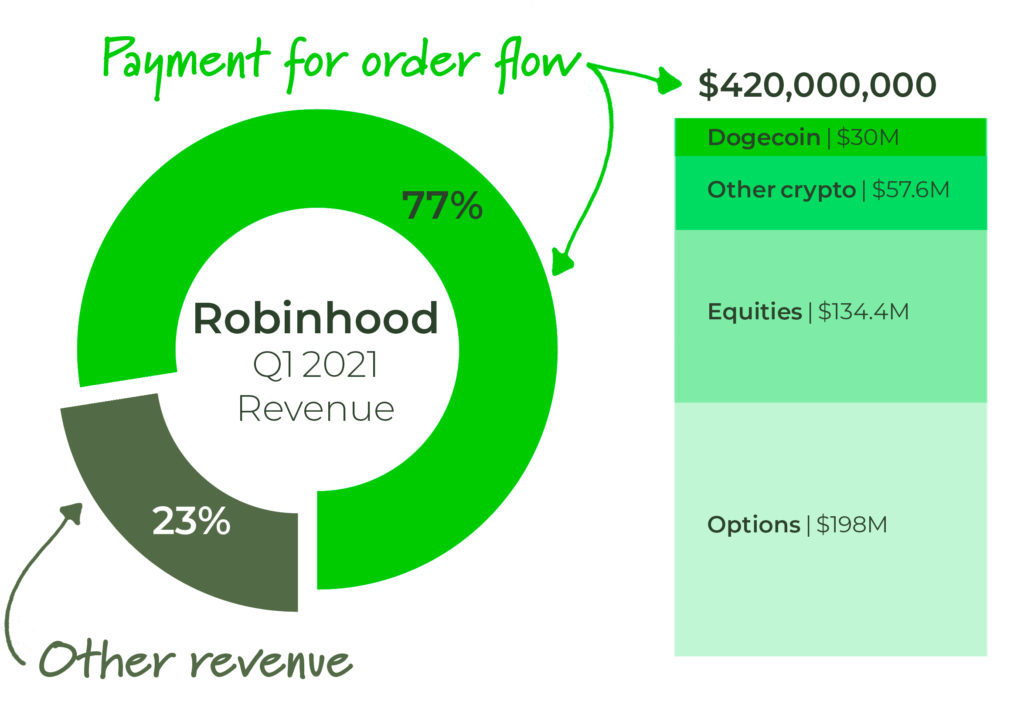

One of the most powerful examples of this is the mobile investing app Robinhood. It advertises itself as a force for “democratizing investing” and “free trades,” but in fact, Robinhood’s primary objective is to get its users to trade options. Per Matt Levine at Bloomberg, in the first quarter of 2021, Robinhood “extracted 9.5% of the value of its customers’ options portfolio for itself.” Compare that to 1.2% of its users’ crypto portfolios and 0.2% of their stock portfolios.

Share this article

In 1Q21, Robinhood’s account holders held $2B of their assets in options. On that $2B, Robinhood generated $198M in revenue. That’s where Levine gets the 9.5%. For every $1,000 in options that Robinhood’s customers held in 1Q21, Robinhood earned $95! Whereas $1,000 in crypto assets or $1,000 in stocks earned Robinhood $12 and $2, respectively.

Where does Robinhood’s take come from? Do its users agree to pay these fees in exchange for the exceptional services provided by Robinhood? No! These fees are paid to Robinhood by market makers like Citadel Securities.

Robinhood’s users are not its customers. The market makers are its customers. Its users are the product. Robinhood makes money on volatility. Options trading on meme stocks is Robinhood’s perfect storm of profits.

I hope it doesn’t require any further explanation to make it clear that Robinhood encouraging its novice users to trade options has nothing to do with “democratizing investing.” Nor does it in any way resemble “free trades.”

At this point you may be asking, “OK, Dr. Smith. I get that Robinhood is less than forthright about its mission, but what does this have to do with the internet?”

It all harkens back to a momentous decision 20 years ago that I like to call, “the day the internet died.” It was the decision made by Google to monetize its search engine results by selling advertising instead of asking its users to pay a fair price.

The day Google started selling advertising, the internet became a tool for gathering and analyzing data on our behavior and using it to nudge us toward the needs of Google’s advertisers. Google’s advertisers are its real customers. We are the product.

In her excellent book The Age of Surveillance Capitalism, Shoshana Zuboff tells the story of how Google created and continues to perfect surveillance capitalism and how it spread across the internet. It may surprise you to know that it all started with a good idea.

In 2000, a group of engineers set out to use technology to monitor the way we behave in our homes – the project is called Aware Home. They imagined a closed-looped system, wherein we would have sole access to our data. We could then use this data to create an “entirely new knowledge system” that would help us live our best lives.

A mere 21 years later and this good idea has gone completely off the rails. Instead of technology being a tool consumers can use to improve their lives, it has become a tool that platform owners, media companies, and advertisers use to manipulate us into spending our time and money in ways that aren’t likely to produce a good return on our investment.

At the dawn of the 21st century with its growing number of services, Google was able to start collecting data on human behavior as people searched and engaged with the internet. Like all of the search engines of the day, they weren’t even doing anything with the data they were collecting on consumers.

But it was only a matter of time before someone figured it out, and that person worked at Google. They realized they were sitting on information that advertisers could use to more effectively sell you stuff. Zuboff writes:

…in addition to key words, each Google search query produces a wake of collateral data such as the number and pattern of search terms, how a query is phrased, spelling, punctuation, dwell times, click patterns, and location.

In a post-9/11 world, all the pieces came together for a perfect storm. With real-time surveillance capabilities, Google, Facebook, and the like can see what we are doing – the way our eyes move, the way we pause on a page – and then use this data to slightly modify our behavior to increase profits.

For the average consumer, there is no way to get on the internet without surrendering information. Just by living our lives in the 21st century, we relinquish a huge amount of our privacy to a few immense corporations.

What does this mean for you as an investor and as an autonomous, free-thinking human being? It means that every time you go online, you must keep your guard up. You have to be self-aware, and you have to constantly ask yourself how your behavior is likely being modified for someone else’s reward.

The internet gives the appearance of freedom and choice, but it’s actually engaged in subtle (and not so subtle) behavior modification 24/7/365. Whether it’s investing, politics, food, or success, we have to ask ourselves constantly, “Who is trying to sell me something?”

Anytime we pull out our credit card online – or even just spend our time reading or watching something – there is risk. We are risking our resources: money, time, and attention. It behooves us to ask ourselves if these risks are likely to produce a reward for us.

The financial world is, I’m afraid, one of the worst offenders. We are constantly bombarded with breathless accounts of the latest meme stock, the price of Bitcoin, the looming stock-market crash, the price of Tesla, the next IPO, and on and on.

Do you feel your heart rate going up? Do you have the urge to take action NOW? That’s the feeling of behavior modification. One minute it’s greed. The next minute it’s fear. The cognitive dissonance is actually part of the strategy. We become like drowning people who start thrashing about in search of something to keep us afloat.

Is it any wonder that Robinhood stepped into this fray with a business model that hides transaction costs from its users? “Hey – let’s remove any remaining friction from transaction costs so that everyone can jump into the water for free!” Oh, in case you missed it, Robinhood recently hired Aparna Chennapragada, a Google executive who spent 12 years leading product, engineering, and design teams.

I created The RISK Rituals to help bring us all back down to earth. The first step in The RISK Rituals is Rest, and it certainly applies to our online lives. We have to check in with ourselves every time we go online and understand that anytime we go online we are risking our time, attention, and sometimes our money. Let’s make sure that we convert that risk into reward!

So, whether you know what you want or are just bored, don’t hop online unconsciously. Start consuming online information on your terms – making a conscious decision about what you consume and where and when you get it.

They say, never go grocery shopping when you’re hungry. I would add, never go to the internet when you’re tired, anxious, angry, lonely, or bored. If you do, you risk rewarding someone else.